Is China the sleeping dragon of the Greece EU exit?

Lately, “debt” has been a keyword in most talking circles. Greece, Italy, Spain, Puerto Rico–even Illinois has its own debt problem. Aside from those in US territories, most analysts predict the global debt crisis facing most European countries will have little to no impact on the US economy. It has not caused any panic–no Janet Yellen statements or Wall Street tumbles. (For a comprehensive breakdown on the Greece crisis click here.)

The Obama administration has even taken a calm approach, urging all parties to work in the interest of Greece on the path to prosperity and as a continued member of the European Union, despite the fact that some banks in the US are among the creditors Greece owes. (The preferred option for the US is for Greece to remain a part of the EU, due to geopolitical influences; if Greece were to exit the EU, China, who has been building its economy for years and increasing its influence beyond Asia could… but we’ll get to that later.) You could say, since the Recession, that some banking rules and structures put in place by this administration have helped weather the storms for other global and regional crises, serving as their bravado in this calm approach (ex: Dodd-Frank Bill). The US government has stayed out of this crisis–but not the institutions that it controls.

What the Greece bailout and other debt crises are really signaling is that we need a new and more competitive institution to help distressed nations. What if competition was part of the process of bailing out distressed countries? It shouldn’t only be the IMF and World Bank bailing out or primarily investing in these countries. Yes, Greece is a part of the EU, and the EU must play a primary role in preserving the Greek economy for the sustainability of the European Union, but the IMF, World Bank, EU and ECB have all been major players in this crisis.

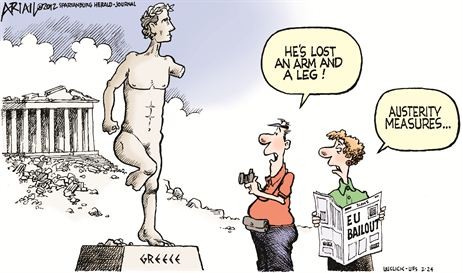

This is not to take away from the fact that this problem was brought on by the Greeks themselves, with reckless spending in the public sector and lax regulations on taxes, (and heck, Athens Olympics 2004?)–the writing for default was on the wall. Every element points to a failed state in Greece, and political instability that seems to mirror changes made in American football players.

The question then is, would Greece be better off if China was a major player in its rebuilding process?

“Already some observers are suggesting a Greek exit from the euro could provide China with the opportunity to move its strategic agenda several paces up the board by buying more Greek assets at rock bottom prices,” Carrie Gracie wrote for the BBC News. If Greece wasn’t a member of the EU, China would’ve been a viable alternative. As Gracie suggests, China is waiting at the door–praying that Greece exits the euro so it can pounce. Like a tiger surveying its prey. In this case, however, the EU, IMF and World Bank are also predators.

The news then, that China, along with more than 50 other countries (including Britain, France and Germany), signed an agreement in April to form the Asian Infrastructure Investment Bank (AIIB) comes as no surprise. For years, China has been at odds with the IMF and World Bank in many areas–governance, trade, rules of engagement. The US, France, Germany, Japan and Britain have wielded enormous power in these institutions and have left no room for China to play an important role in global developments and in the way countries modernize. They often cite China’s record on human rights, transparency, and the environment as the main reasons behind this exclusion. Both the US and Japan declined to be members of this China-led institution. No doubt, China is pushing to be a major player in both regional and international development, as evidence by its moves in the South China Sea and the new AIIB.

The strategy for the EU has been to change the way government is run in Greece, make sure that Greece is part of the EU and that the euro is maintained as the single currency amongst its 19 member countries. Most important, also, is setting a precedent amongst its members (especially those struggling with debt, i.e. Spain, Portugal and Italy) that the EU will not be an institution that continues to pump money into countries who have not modernized their economy. Modernization, in the sense that, for years, even before it became a member of the EU in 2001, Greece has had an economy where government (public sector) was the largest employer, which means it has a high pension obligation, and a really weak tax collection system to boot. By all fact-based accounting systems, Greece should have never been a member of the EU.

The EU, IMF and World Bank are the ones to blame for this uncertainty. They knew that Greece’s economy was not sustainable and yet still loaned money and allowed Greece to become a member of the EU. Big banks–the JP Morgan’s, Barclays and other major banks–made money in the short run, and are now trying to force Greece to change its economy, when changes to the structure of the Greek economy should’ve been a precondition for any association. No doubt, Greece has to reform its economy to remain in the EU and to continue to receive loans, but it has to be on its own terms.

Greeks resoundingly rejected the measure set forward by the ECB and IMF, voting by a margin of 61% to 35% that large austerity (cutting government spending) and deregulation, is not the solution to their problem. As the rest of Europe, and the world, awaits EU response, it’s time, too, to start looking at alternatives for helping distressed countries.